Before I was a Stay-at-Home Mom, I was an Office Manager. I remember each year being responsible for informing employees about open enrollment and answering any questions they had regarding their health insurance benefits. However, I normally didn’t get many questions or changes in plans. Employees were typically only worried about the amount that was coming out of their paycheck rather than the coverage they were getting. This can be a costly mistake and Aflac conducted the 2012 Open Enrollment Survey of the Aflac WorkForces Report to learn more about open enrollment and employee benefits.

What is Open Enrollment?

Open enrollment is the period that companies hold to allow employees to enroll in or change their current health benefits. It only occurs once a year, typically in the fall, and last for only a week or two. The choices you make can not be changed for the whole year, until the next open enrollment period, so it is extremely important to understand the process and your options.

What are Common Mistakes During Open Enrollment?

Aflac found that only 16% of workers are confident they are NOT making mistakes during the open enrollment process. That is such a low percentage! Some common mistakes found:

- Members are on auto pilot and aren’t aware of the options

- 61% of employees surveyed were not aware of changes to their policies

- 89% simply pick the same level of benefits each year

- Only 16% contribute the right amount into their flex spending account

What’s the Big Deal?

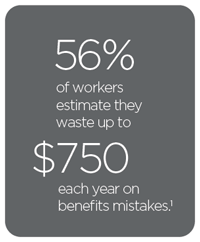

Choosing the wrong coverage can be very costly. The cost of coverage and out-of-pocket expenses are on the rise and employees are frequently worrying about unanticipated medical expenses. 24% of survey respondents say they have the wrong coverage and benefit options. With that and other benefit mistakes, over 56% believe they are wasting up to $750 a year! That is a lot of money wasted due to mistakes and lack of knowledge.

What Can You Do?

To get the most out of open enrollment and reduce your chances of wasting money on benefits, I recommend following a few suggestions.

- Review your healthcare costs from previous years to estimate an average cost to expect for the following year.

- Ask questions. Become knowledgeable about your current plan and the other options you have.

- Do not set up your insurance on auto pilot. This way you aren’t automatically choosing the same coverage each year.

- Become aware of and changes to your current plan.

- Follow @Aflac on Twitter for tips on benefits, coverage, and open enrollment.

For more information on the 2012 Open Enrollment Survey of the Aflac WorkForces Report, view the infographic and visit AflacWorkForcesReport.com.

“I wrote this review while participating in a campaign by Mom Central Consulting on behalf of Aflac and received a promotional item to thank me for taking the time to participate.”