Creating a savings plan and a personal budget doesn’t have to be difficult. What’s important is finding something that works for you; Something that you will keep up with to help manage your money. While this post is sponsored by EveryDollar, all opinions are my own.

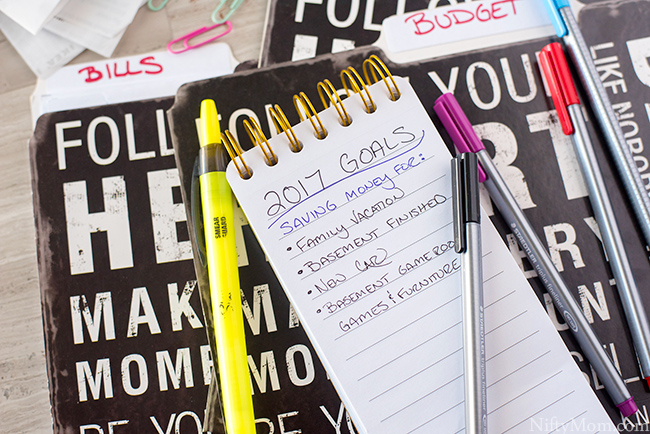

I am sure you know by now I am always making lists. I always have at least five lists in front of me. With the start of the new year just over a month ago, I am still going through my new 2017 lists. There are many things I hope to accomplish this year personally, professionally and financially.

For 2017, we also have a lot of things we want to do as a family and around our house. Most of them require saving some extra money this year. As we are beginning to finish our basement, the costs add up quickly. I have been trying to move money around and see where we can spend less, but it can be frustrating.

I pull out receipts, our monthly bills and start throwing numbers into a spreadsheet. I am a huge fan of spreadsheets and anything I can use to visual see patterns, charts, and numbers. I have been doing this for years. However, most budgets last just a month or two.

Maybe I don’t quite like the way the spreadsheet visually looks. Maybe I realized missing categories and I am not sure what to change. Maybe after looking at all the numbers and trying to make decisions, I just plain give up. For whatever reason, I get frustrated and the budget gets forgotten and our spending goes back to the way it was. Without a budget and seeing the numbers a few times a week, we spend way more than we should.

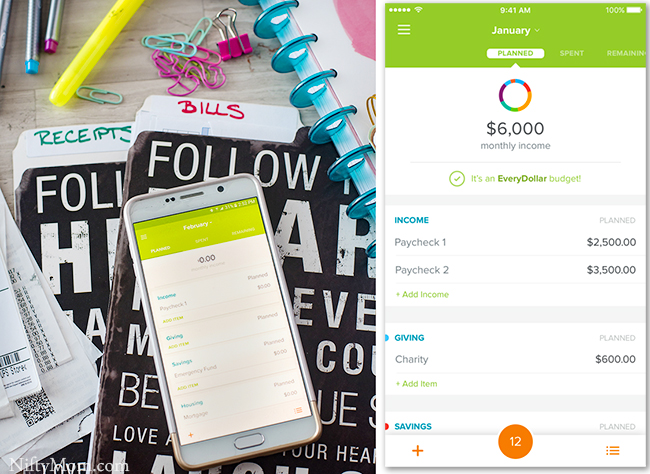

This year we are trying something different. No spreadsheets. No spending endless hours trying to figure out how to make the numbers work. We downloaded the EveryDollar App to get control of our budgeting and stick to it. The free app (available on iOS, Andriod & online) takes less than 10 minutes to create the first budget. That’s it.

Since we are using a mobile app now, my husband and I can each access our budget and track our spending on the go, even when we are not together. I can’t tell you how many times he has called me asking about what we have where or how much we have spent on things. Now he can simply pull up the app and see what the remaining funds are.

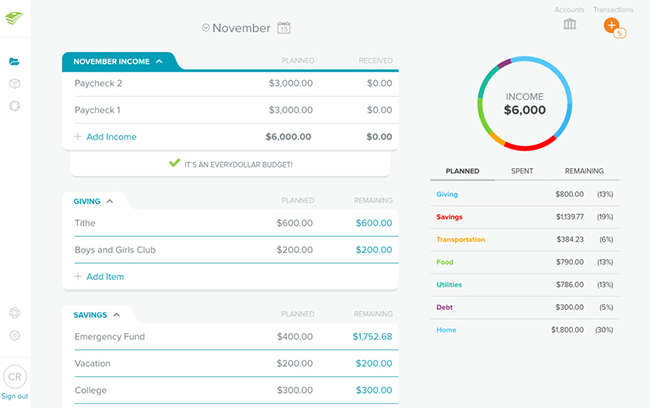

Earlier I mentioned my spreadsheets not really being visually appealing. The look and layout of the EveryDollar App is very convenient and easy to read.

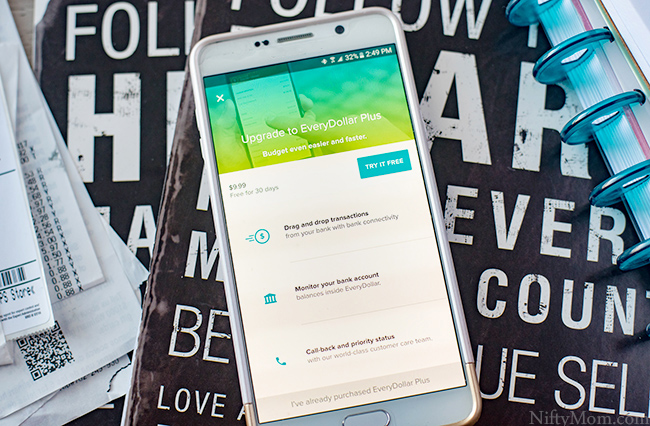

For even more perks, you can upgrade to EveryDollar Plus for yearly fee. This allows you to connect your bank account and sync accounts to track expenses even faster.

The ease over using the app versus creating my own spreadsheets is tremendous. We can really see where we need to spend less and how much we have saved for basement funds, vacation funds, etc. Once you start using it, you can easily find what works best for you and what tracking or savings you want to focus on each month.

Do you have a budget or savings plan? Download EveryDollar for free and give it a try!